According to the amendments and additions to the Tax Code of the Republic of Azerbaijan, as of 01/04/2017 entities registered for VAT purposes and persons specified in Article 218.1.2 of the Tax Code of the Republic of Azerbaijan shall submit e-invoices for the goods delivered (shipped), works done and services provided in connection with entrepreneurial activity. Electronic invoices (e-invoices) shall be made available to taxpayers in two ways:

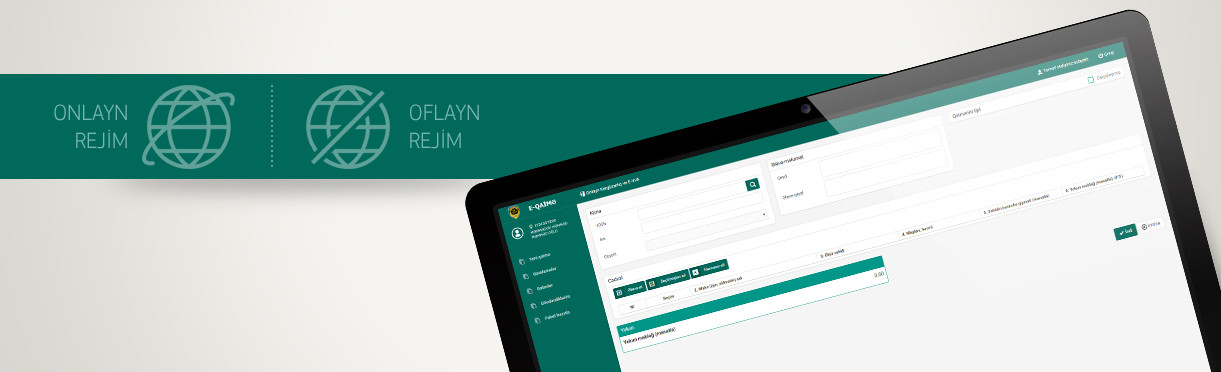

- "In the online mode" - " - Using an enhanced electronic signature tool, the taxpayer selects the "Online clerical work and e-Tax Account Invoice (e-TAI) section of the Internet Tax Administration (www.e-taxes.gov.az) ), goes to the “E-invoice” subsection, and submits e-invoice to another taxpayer after composing it online. (Online filing of electronic invoices (via the "E-invoice" sub-system) - https://www.e-taxes.gov.az/help/#eqf01).

- "In the offline mode" - the taxpayer, with the aim of composing an electronic invoice, downloads the latest version of the special software ("Electronic Invoicing Software - eFP") and other necessary applications from the "Required Apps" subsection of "e-Invoice" section at the Internet Tax Administration his/her computer, compose and packs the required invoices through this application without the need to access the Internet. After that, the package file is signed in the offline mode either with the use of "Asan DOC client" or the "e-Signer" application (note that the "Asan DOC client" application can be downloaded at www.asanimza.az, and the "e-Signer" application at www.e-imza.az ). The user can also sign the file through the ASANDOC portal. Finally, using an enhanced electronic signature tool (Asan Signature or Electronic Signature), the taxpayer selects the "Online clerical work and e-TAI" section of the Internet Tax Administration, goes to the "Electronic Invoice" sub-section and uploads the signed "adoc" or "edoc" file into the system using the "Send package" button. During the download, the e-invoices will be assigned unique serial numbers and numbers by the system and sent to the taxpayers’ email box. After that all other operations are performed online. This mode is mainly intended for large taxpayer. It is recommended that taxpayers who submit a large number of electronic invoices use this mode.

Electronic invoicing in the online mode (via the "Electronic Invoice" sub-system)- https://www.e-taxes.gov.az/help/#eqf01

Required Apps - https://www.e-taxes.gov.az/dispatcher?menu=evhf&submenu=4&nav=evhf

Codes of Goods, Works and Services Codes used when completing an electronic invoice

Print

Print